Income tax marginal rates 2021

Remove IRS Tax Liens. Ad Compare Your 2022 Tax Bracket vs.

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

California state tax rates are 1 2 4 6 8 93 103 113 and 123.

. These are the federal income tax brackets for 2021 and 2022. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. The Colorado income tax has one tax bracket with a.

0 would also be your average tax rate. A 1 mental health services tax applies to income. Detailed California state income tax rates and brackets are available on this page.

23 February 2022 See the changes from the previous year. On May 10 2021 Governor Brad Little R signed HB. Taxable income Tax rate.

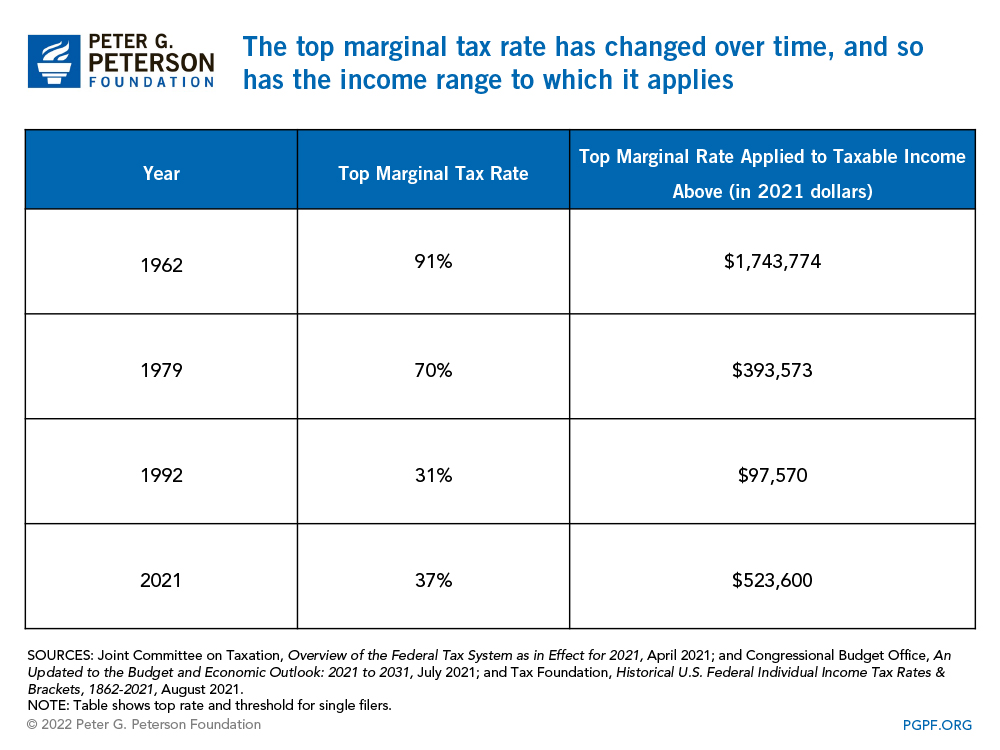

Taxable income R Rates of tax R 1 226 000. In the 2021 tax bracket for instance someone who filed taxes as a single person paid 12 on the first 9950 of their annual taxable income. This report presents a series of figures showing the stylized marginal and average tax rates faced by typical family types as income varies.

Your 2021 Tax Bracket To See Whats Been Adjusted. 353 101 488 700. For individuals income tax rates are based on your total income for the year.

15 on the first 50197 of taxable income plus. The amount of income tax owed and tax benefits received at any level of income is determined by the interaction of the taxpayers income and filing status with other characteristics of the tax unit. The California income tax has ten tax brackets with a maximum marginal income tax of 1330 as of 2022.

226 001 353 100. A permanent reduction of Colorados flat individual and corporate income tax rates changed it from 463 to 455. 40 680 26 of taxable income above 226 000.

See what makes us different. Here is a list of our partners and heres how we make money. There are seven tax brackets for most ordinary income for the 2021 tax year.

California has nine tax brackets. Partner with Aprio to claim valuable RD tax credits with confidence. At higher incomes many deductions and many credits are phased out.

Any additional income up to 40525 will be taxed in the next tax bracket at 12. 10 12 22 24 32 35 and 37. We dont make judgments or prescribe specific policies.

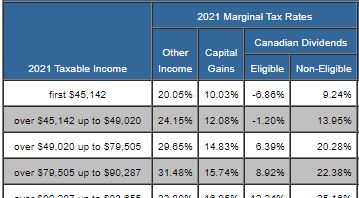

1 2 4 6 8 93 103 113 and 123. 380 reducing the states top marginal individual income tax rate from 6925 to 65 percent while consolidating seven individual income tax brackets into five. 205 on the next 50195 of taxable income on the portion of taxable income over 50197 up to 100392 plus.

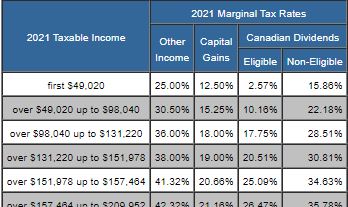

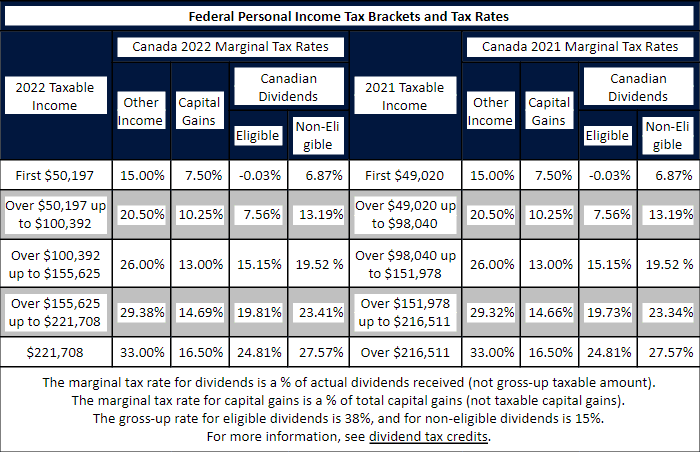

19 cents for each 1 over 18200. Discover Helpful Information And Resources On Taxes From AARP. Examples below use marginal tax rates in effect in 2021 ie associated with 2021 income tax returns generally filed in 2022.

18 of taxable income. 10 12 22 24 32 35 and 37. Your income puts you in the 10 tax bracket.

29467 plus 37 cents for each 1 over 120000. Your tax bracket shows the rate you pay on each portion of your income for federal taxes. 2021 Income Tax Brackets Taxes Now Due October 2022 With An Extension For the 2021 tax year there are seven federal tax brackets.

Resident tax rates 202122. The In Focus examines the mechanics of statutory marginal tax rates and does not analyze the taxpayers effective marginal tax rates which may differ. Pricing Starts At 97.

Your Federal taxes are estimated at 0. As of 2022 there are seven marginal tax rates or brackets. From 1 April 2021.

The rates increase as your income increases. For each dollar of income Tax rate. Skip to main content.

Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth. This is 0 of your total income of 0. Your filing status and.

Tax on this income. Over 14000 and up to 48000. Ad Tax Preparation Services Ordered Online In Less than 10 Minutes.

26 on the next 55233 of taxable income on the portion of taxable income over 100392 up to 155625 plus. These changes were retroactive to January 1 2021. Here are the rates and brackets for the 2021 tax year which youll file in 2022 via the California Franchise.

Effective marginal tax rates reflect the amount of tax paid on. Set Up An IRS Payment Plan. Forty-four states levy a corporate income tax.

73 726 31 of taxable income above 353 100.

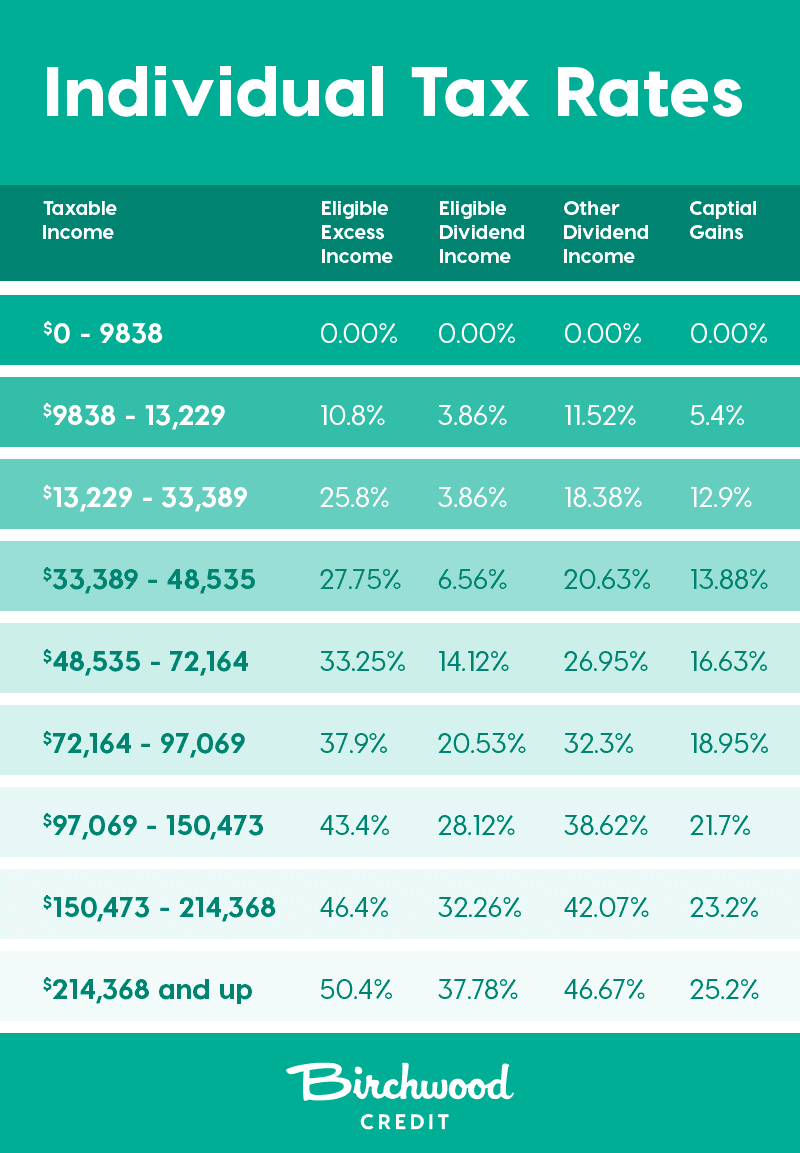

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Personal Income Tax Brackets Ontario 2021 Md Tax

Personal Income Tax Brackets Ontario 2020 Md Tax

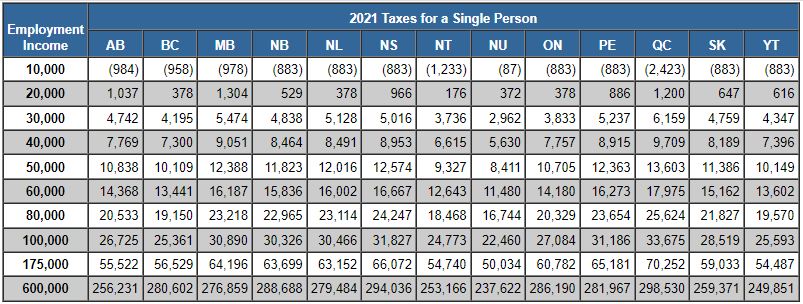

Taxtips Ca 2021 Tax Comparison Employment Income

Taxtips Ca Personal Income Tax Rates For Canada Provinces Territories

Autonomous Testing Of Services At Scale Facebook Engineering How To Introduce Yourself Integration Testing Developer Tools

Personal Income Tax Brackets Ontario 2019 Md Tax

Taxtips Ca Alberta 2020 2021 Personal Income Tax Rates

Tax Brackets Canada 2022 Filing Taxes

Manitoba Tax Brackets 2020 Learn The Benefits And Credits

2021 Tax And Rate Budgets City Of Hamilton Ontario Canada

How Do Tax Brackets Actually Work Youtube

Winter 2021 Canadian Income Tax Highlights Cardinal Point Wealth Management

Fast Company S 100 Best Workplaces For Innovators 2021 Fast Company Best Workplace Workplace Best

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

How Do Marginal Income Tax Rates Work And What If We Increased Them

Taxtips Ca Ontario 2020 2021 Personal Income Tax Rates